- “The project is located a km or so away from the proposed metro station/airport” What to do Do the necessary due diligence on the proposed project, starting from the website of the authority concerned. Visit the location. Rely more on the existing infrastructure.

- “Last few flats left, book now” What to do See the number of prospective homebuyers who have come to meet the real estate agent. Visit the construction site to see the progress. Check the the pace of activity in adjoining sites. Seek advice from online groups.

- “Book now. Prices are expected to move up very soon” What to do Check movement of capital values in the locality over the past one year. If there has been a rapid rise in prices, find out the reasons.

- “Book now and get free gifts” What to do Try to evaluate the monetary value of the gift. Go for a house that fulfils your requirements. Do not let the freebies on offer dictate your decision.

- “Prices are on their way up” What to do Don’t lose patience; wait till you find a house that fulfils your requirements. Real estate is no different from other asset classes. If prices go up during a particular period, they will also come down during a downturn.

- You are shown the sample flat and persuaded to make a buying decision based on that What to do Insist on checking the space that is being provided in the layout of the actual flat. Get an idea of the ratio between the carpet area and the super-built up area.

- “No EMI till possession” What to do See how much extra the developer is charging because of the offer. Check all the terms and conditions.

- You pay the booking amount to the developer but the lending institution refuses to approve the loan for the said project. What to do Check if the developer has a tie-up with any home loan financing company (HFC). Enquire about the soundness of the project. Take the HFC’s help to check the property title, the sanctioned plan and the necessary clearances.

- You have selected the property, even paid the booking amount to the developer but the lending institution refuses to approve the loan to you. What to do At least six months before you plan to take a loan, apply for a copy of your credit history from Credit Information Bureau (India). In case there are any anomalies, get them sorted. If you have been servicing other lines of credit, make sure you do so regularly.

- You select the property, pay the booking amount, but the lending institution does not approve the amount of loan as per your requirement. What to do. Take the help of a valuer before you sit down to negotiate. Apply for a loan with at least 2-3 HFCs. Choose the HFC that gives you the loan at the best rate of interest, and of an amount that’s close to your agreed sale price.

***

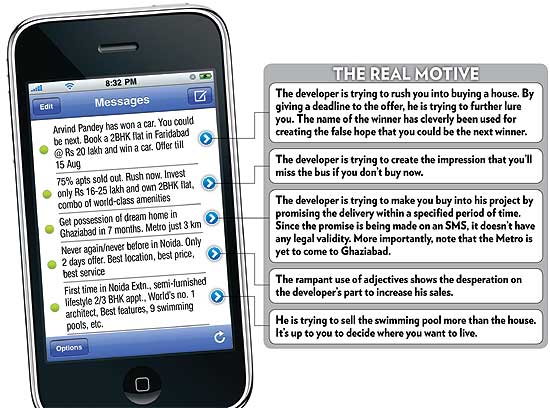

Of late, have you been receiving pesky texts advertising property launches with ridiculous frequency? Oh, that wasn’t supposed to be a question! Of course, you have been, and believe us, you are not alone. In fact, from national dailies to local FM channels, the clamour—soon-to-be-over deals, freebies and prime locations—is ubiquitous. Almost makes you believe the heady days of the pre-recession era are back. But actually, it’s the other way round.

Following the global economic crisis, homebuyers started to come back to the market around October-November 2009. The next six months or so saw huge volumes as sales picked up. However, festivities for the sector seem to have fizzled out. Says Pankaj Kapoor, founder and chief executive officer (CEO), Liases Foras, a real estate research firm: “Sales have virtually reached a real low in the last few months. In Pune, sales are down 50 per cent compared to the last quarter, while in Mumbai they are down 25-35 per cent. The same is the scenario in Chennai, Bangalore and other cities.” Clearly, real estate developers are under a lot of pressure stemming from unsold inventory and slumping sales, which have led to very low liquidity. With their backs to the wall, the only recourse for developers is getting rid of the unsold inventory. The recent marketing frenzy is aimed at just that and, needless to say, deals often smell fishy, if not outright dishonest.

The

modus operandi of the whole exercise is simple yet effective: make the offer sound unbelievably good and instil a false sense of urgency in the mind of the consumer. More often than not, the human psyche falls prey to this set-up of temptation and fabrication.

Behind The Freebies

A look at what has forced real estate developers to come up with a deluge of lucrative offerings

- Compared to October 2009-March 2010, sales volumes were drastically down over April-June 2010 primarily because home prices had risen sharply, especially in select locations in Mumbai and Delhi NCR.

- Poor sales have led to inventory piling up at the developer’s end. The freebies offered by developers are aimed at attracting prospective homebuyers.

- It is difficult for developers to lower prices beyond a certain point. The freebies, developers believe, will support the prevailing prices by generating interest among homebuyers.

Take, for example, the deluge of freebies being offered by the developers, most of whom are relatively new and lesser known. In fact, established developers usually do not resort to such measures.

Although there might be a handful of exceptions (the chances of which are abysmally low), the truth remains that developers have laid booby traps for prospective homebuyers. The marketing spiel, of course, varies from seller to seller. In this story, we highlight the 10 common traps that can get the better of the prospective homebuyer (some laid by developers and some self-created), the dangers of falling into them and, most importantly, the suggested course of action to negotiate this obstacle course.

“Go by the existing infrastructure. Don’t bother much about the proposed infrastructure; pay higher value because of that only to an extent” — Pankaj Kapoor, Founder and CEO, Liases Foras “Go by the existing infrastructure. Don’t bother much about the proposed infrastructure; pay higher value because of that only to an extent” — Pankaj Kapoor, Founder and CEO, Liases Foras | |  “We observe that prices have run up in the last one year. In some cases, they have even reached the peak” — Pranab Datta, Vice-Chairman & Managing Director, Knight Frank (India) “We observe that prices have run up in the last one year. In some cases, they have even reached the peak” — Pranab Datta, Vice-Chairman & Managing Director, Knight Frank (India) |

|

“While visiting a sample flat, what matters most is not its visual impact, but an understanding of how the available space in an unfurnished flat can be used” — Anuj Puri, Chairman and Country Head, Jones Lang Lasalle Meghraj “While visiting a sample flat, what matters most is not its visual impact, but an understanding of how the available space in an unfurnished flat can be used” — Anuj Puri, Chairman and Country Head, Jones Lang Lasalle Meghraj | |  “For EMI sharing schemes, the consumer is charged a slightly higher price than those prevailing in the market (but this is not made evident to him)” — Aditya Verma, Coo, Makaan.Com “For EMI sharing schemes, the consumer is charged a slightly higher price than those prevailing in the market (but this is not made evident to him)” — Aditya Verma, Coo, Makaan.Com |

“project will be located a km (or so) away from the proposed metro station/airport”

Recently, this has been a common sales gimmick, especially in the National Capital Region (NCR). Once an infrastructure project is announced in a particular location, capital values in the locality go up. In Bengaluru, for instance, capital values had shot up as soon as the plan for the new international airport at Devanhalli was announced. In cases like this, the developer is trying to sell you the location rather than the house. Historically, there have been significant delays when it comes to the completion of infrastructure projects in India. To give you an idea, the recently commissioned Bandra-Worli Sea Link was completed with a delay of five years. If you book a unit in the hope that an infrastructure project will come up nearby, you may end up in a location devoid of any social infrastructure. Plus, if you book such a unit for investment purposes, you would need to hold on to it for a long time before there is any meaningful increase in capital values. The worst part, however, is that the developer will charge a premium for the unit based on future capital appreciation, which depends on the materialisation of the infrastructure project.

Course of action. Even before you visit the location, check the project’s status on the website of the authority concerned. Check the scheduled completion date and the authority’s track record in meeting deadlines. After these preliminary checks, visit the site to see how far the house is from the project’s proposed location. Look for signboards or any construction work happening there.

If you are satisfied with the house, take a look at the infrastructure available and don’t bother much about what’s proposed.

“Last few flats left, book now”

This is a common sales pitch you will come across. Here, the real estate agent is trying to play with your psyche. It’s well known that buying a house is arduous and, many a time, you just want to close the deal. The developer/agent is trying to target this particular vulnerability. If you take him at his word, you might end up making a mess of the budget you had allocated for your home purchase.

Course of action. When the real estate agent gets pushy and makes such statements, look for a few things to find out if he is telling you the truth. First, see how busy he is. The number of prospective homebuyers that have come to meet him is usually a good indicator. Second, see the progress on the construction site. A project that is witnessing demand and has people lining up will also have some progress on the ground. Check the adjoining sites and see the pace of activity at those locations. If there is hardly any work going on, looking at another project and another location would not be a bad idea.

You can also consult online groups for feedback on the project you are interested in. Says Vineet K. Singh, business head at realty portal 99acres.com: “Nowadays, online groups are getting popular. Members put in their experiences for unknown online friends freely, without much hesitation.”

The Lingo Of Deception

These days, every second text message you receive on your mobile entices you to buy or invest in a housing project. Here are examples of the typical SMS language used and the real intent behind it.

“Book now. Prices are expected to go up very soon”

This is another attempt at taking control of the buyer’s psyche. If you buy the spiel, you will end up booking the unit in haste. Obviously, the chances of your making a mess of the budget rise, not to mention the potential loss you will incur if the price of the unit falls in future.

Course of action. As a first step, check the movement of capital values in the location over the last one year. If capital values in the locality have appreciated at a higher rate than other areas of the city, find out the reason. There are chances that you would not find a solid reason for the rapid increase. In that case, it makes sense to give the property a miss. The rapid increase in prices in a certain locality without a substantial reason is an indication of speculators being very active. Says Samarjit Singh, managing director at Agni Group, a property broking company: “Try to book a unit while the project is in its early stage to avoid such issues. Go for flats directly available from developers.”

“Book now, get free gifts”

With inventories piling up, developers have started to attract homebuyers with freebies (cars, club and swimming pool memberships, and so on) instead of bringing down prices. Says Aditya Verma, chief operating officer (COO), makaan.com, a real estate portal: “With many housing projects coming up and a huge inventory to dispose of, developers are forced to offer such incentives and freebies to attract homebuyers to maintain the prevailing price level.” However, note that most of these freebies are offered by lesser known or new developers. Established players seldom try to sell a project by offering freebies.

Course of action. Your decision should never be influenced by the freebies on offer as most of them are insignificant compared to the apartment’s price. Even if there is an offer, evaluate its monetary gains before you book the property. Usually, the cost of such offers is bundled with the cost of the house.

Some developers might say that by booking a unit in the project, you will be eligible for a lucky draw. Remember, the probability of your hitting the jackpot is miniscule. If you lose, which the majority does anyway, your money will go towards funding the prize of the winner. While buying a house, it is more important to see if the property meets your requirements and if it is within your budget. Do not get carried away by offers.

“Prices are going up”

The typical real estate agent is a brilliant orator. When he speaks about house price movements in the recent past, thanks to half-truths supplemented by his never-ending drivel, the average customer starts feeling like a loser. News of price increases don’t help either—it aggravates this feeling of loss.

Course of action. India faces a huge housing shortage, which means there will always be demand for good quality housing. Over the long term, therefore, prices of residential units will go up. But there is no need to lose patience. Decide on a budget for buying the house and start raising the downpayment money. Once you have located the right house, go ahead and buy it. Remember that real estate is no different from other asset classes. If prices go up, they also come down during a downturn. No one can tell the exact state of affairs, say, six months down the line.

You are shown a sample flat in the project you intend to buy

This is very common. Usually, the developer or the real estate agent will show you a sample flat saying your flat will be almost similar to it. The reason why you should not base your buy decision on the sample flat is that there may be a huge difference in what is being shown and what you would get. “In case of a sample flat, most of the items on display inside the house don’t form part of the standard apartment being sold,” says Pranab Datta, vice-chairman and managing director, Knight Frank (India), a realty consultancy. Generally, the premises in which the sample flat is built have well-maintained gardens and fountains to entice you. They may not be part of the actual project.

Course of action. Once you have seen the sample flat, go and check the space being provided in the layout of the actual flat. Get an idea of the ratio between the carpet area and the super-built up area. “A buyer needs to check how much he is paying and how much usable area he is getting,” says Kapoor.

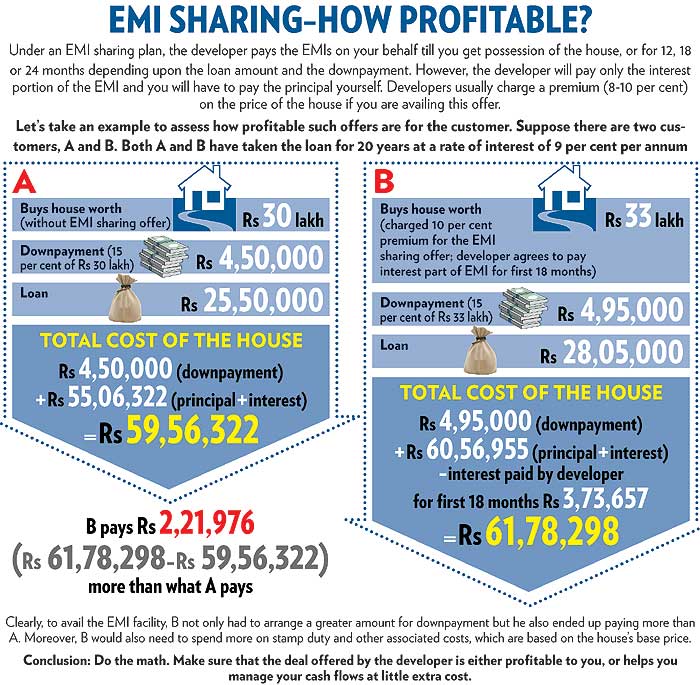

“No EMI till possession”

This line traces its origin to the 2008-09 lull in the residential property market. EMI sharing schemes are on offer even now. The trap here is that developers try to show the homebuyer how cheap it is to buy a house with some ‘initial assistance’. Developers providing such a facility typically charge 8-10 per cent higher prices than those prevailing in the locality (see EMI Sharing-How Profitable?). Says Anuj Puri, chairman and country head, Jones Lang LaSalle Meghraj, a real estate consultancy: “Note that the EMI burden is already factored into the builder’s costs.”

Course of action. EMI sharing can help a homebuyer on two fronts. First, one of the major concerns of the buyer is to get the house’s possession on time. With an EMI sharing scheme, the developer’s commitment to completing the project on time increases. Says Verma: “By offering EMI sharing, the developer is displaying the confidence of executing the project on time.” That’s because the sooner the developer hands over the possession, the earlier he will get rid of the EMI burden. The second aspect is that EMI sharing can help a homebuyer manage his cash flows more efficiently in the initial stage of homebuying. Says Samarjit Singh: “Developers sometimes charge extra for such schemes, so one needs to see if it will help him with his cash flows.”

However, before you opt for an EMI sharing scheme, you must check the terms and conditions. Warns Vivek Dahiya, founder and CEO, GenReal Property Advisors: “One needs to be careful and make sure he reads the fine print and understands the liabilities.”

You book the house but lender refuses loan for that project

Such a situation may arise if the developer’s persuasion got the better of your wit, and you booked the unit without the necessary due diligence. If the lending institution refuses a loan for that project, your money will get stuck at the developer’s end.

Course of action. Before you make the downpayment, do the necessary due diligence. First, you should check if the developer has a tie-up with any home loan financing company (HFC). If he has, get in touch with the HFC and enquire about the project’s soundness. If there is no such tie-up, then approach an HFC and ask them if the project concerned is on their approved list.

You could also hire the services of a lawyer from the HFC to ensure that the developer has a clear title to the land on which the project is being built. The HFC should be able to tell you if the project is being built as per the sanctioned plan. You should also check if the developer has the necessary clearances.

You book the house but lender refuses to approve loan to you

Situations like this are a demon of your own making. Usually, the lending institution refuses to approve the loan application if you have a bad credit history. In such a case, chances are that you will not be able to get a loan from any lending institution.

Course of action. At least six months before you plan to take a loan, apply for a copy of your credit history from Credit Information Bureau (India), Cibil. If you notice anomalies, get them sorted out. Clear any small-ticket loans before applying for a home loan—any existing loan at the time of application will reduce the amount of home loan you can expect to get.

You book the house but lender doesn’t approve loan amount

Such a situation usually arises in the case of resale of property. If the lender doesn’t agree to sanction the amount of loan you applied for, you will need to dig into your resources to make a bigger downpayment.

Course of action. Once you select a property, get it evaluated by a professional valuer. This will give you an idea of how much you can bargain. Try to bring the price as close to the valuer’s figure as possible. If you can’t make any headway, look for a property elsewhere. But if you are able to arrive at a price that is close to the valuer’s figure, pay the booking amount and apply for a loan with 2-3 HFCs. That’s because each of them will have their own parameters to evaluate the property. Choose the HFC that gives you the loan at the best rate, and of an amount that’s closer to your agreed sale price. This way, the downpayment you’d need to arrange will not be huge.

Owning a house is your pride and joy. But the journey to buying one abounds in traps that could mar the entire experience and render it unforgettable. Brace yourself up for it, it’s a cruel world out there.

“Go by the existing infrastructure. Don’t bother much about the proposed infrastructure; pay higher value because of that only to an extent” — Pankaj Kapoor, Founder and CEO, Liases Foras

“Go by the existing infrastructure. Don’t bother much about the proposed infrastructure; pay higher value because of that only to an extent” — Pankaj Kapoor, Founder and CEO, Liases Foras “We observe that prices have run up in the last one year. In some cases, they have even reached the peak” — Pranab Datta, Vice-Chairman & Managing Director, Knight Frank (India)

“We observe that prices have run up in the last one year. In some cases, they have even reached the peak” — Pranab Datta, Vice-Chairman & Managing Director, Knight Frank (India) “While visiting a sample flat, what matters most is not its visual impact, but an understanding of how the available space in an unfurnished flat can be used” — Anuj Puri, Chairman and Country Head, Jones Lang Lasalle Meghraj

“While visiting a sample flat, what matters most is not its visual impact, but an understanding of how the available space in an unfurnished flat can be used” — Anuj Puri, Chairman and Country Head, Jones Lang Lasalle Meghraj “For EMI sharing schemes, the consumer is charged a slightly higher price than those prevailing in the market (but this is not made evident to him)” — Aditya Verma, Coo, Makaan.Com

“For EMI sharing schemes, the consumer is charged a slightly higher price than those prevailing in the market (but this is not made evident to him)” — Aditya Verma, Coo, Makaan.Com